Thousands of UK retail jobs are being cut every day as a result of a squeeze on the high street because of the coronavirus pandemic. The lockdown, which commenced in late March, saw thousands of shops around the country close their doors for months – with many never opening again. Yesterday, Marks & Spencer announced it planned to cut 7,000 jobs over the next three months.

Debenhams has also announced it plans to cut jobs, some 14,000, after a report suggested the shop’s owners were drawing up plans for its liquidation as a result of an intense dip in sales.

Another, WH Smith, is considering cutting 1,500 jobs – a hefty 11 percent of its workforce – after sales plummeted because of lockdown.

The UK high street was already failing before the coronavirus pandemic hit.

The colossal job loss numbers are not new because of COVID-19 – only higher.

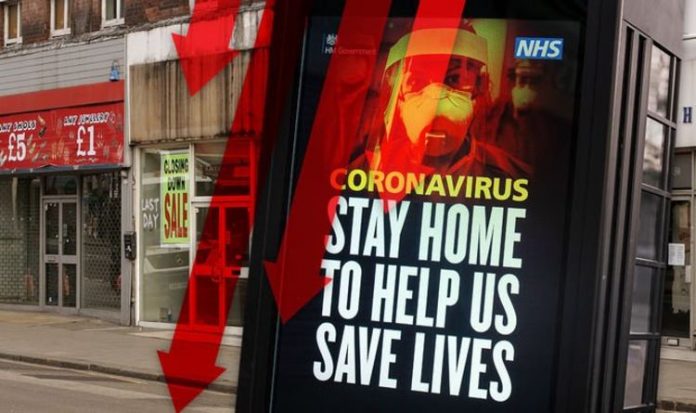

Coronavirus: The pandemic and lockdown has accelerated the devastation of the UK high street (Image: GETTY)

UK retail: Many shops have been forced to give up their leases (Image: GETTY)

The Centre for Retail Research calculates that 2018 saw 117,000 jobs going across the UK, and more than 14,000 units closing.

It says last year saw 143,000 jobs going, and the closure of more than 16,000 shops.

Around a third of those job losses were due to companies going bust: others were due to slimming down, and shedding less profitable units.

The forecast for this year – 243,000 fewer retail jobs – was based on data available in the early weeks of lockdown, so did not take account of it lasting longer than first expected.

JUST IN: Bloodbath on the High Street: 300,000 jobs could be lost

Independent stores: Many independent shops across the country have been forced to close their doors (Image: GETTY)

Customer habits were already shifting, many now shopping online, with retailers such as Amazon offering same-day delivery deals the high street could not challenge.

Lockdown measures were eased in England in June, with many rushing out to physically visit the shops for the first time in months.

However, even as they re-opened, shops are having to contend with lower footfall, and infection controls constraining numbers and interaction in stores.

Many high street names are now being forced to “restructure” – but this process is lengthy, with shop bosses having to decide where they will pull back branches around the country.

DON’T MISS

Overdraft: 85% of high street banks will have raised rates this month [REPORT]

Stacey Dooley rants about ‘naff and outdated’ issue [INSIGHT]

FTSE 100 LIVE: Pound nears five-month high as Brexit talks restart [ANALYSIS]

Rishi Sunak: The chancellor announced that the country was officially in recession this month (Image: GETTY)

UK coronavirus: Thousands of jobs have already been lost with many more likely to follow (Image: GETTY)

Added to this is the weariness about the return of workers to the office – with retail bosses in the dark about whether inner city stores will ever reach pre-COVID customer numbers.

Retailers also have the additional problem of securing rent agreements with their landlords – many of which are long leases of up to 25 years.

Despite a fairly bleak picture, some have predicted that retail may completely bounce back, gradually becoming used to the new restrictions.

Patrick Minford, Professor of Economics at Cardiff University, wrote in The Daily Telegraph last month struck a lighter note.

IMF: The IMF predicts a sharp bounce back in the next year (Image: Express Newspapers)

He argued: “There will be much less change than current fashion would have you believe.”

Instead, the high street might in fact bounce back, with retailers enjoying the easing of lockdown, with June’s retail sales figures from the British Retail Consortium revealing how, actually, all have recovered their losses to show 3.4 percent growth on June a year ago.

As Prof Minford noted: “That is remarkably V-shaped, after the precipitous drop under lockdown.”

Retail sales rose again in July, but shops continued to make up for ground that was lost during the lockdown.

Debenhams: The department store is at risk of liquidation (Image: GETTY)

However, many, including Mark Hart, deputy director of the Enterprise Research Centre, have argued that any initial resurgence may not last.

He told Ms Bernal that the economy will likely take the form of a “pincer movement” of higher business closures and a lack of new businesses taking their place.

He said: “In that context, rather than seeing a V-shaped rebound as some economists have predicted, we could instead see an L-shape dragged down by a net loss of companies over a long period.

“The insolvencies are stacking up. And I believe the private sector is going to lose a few million jobs between now and autumn.”

And, many have argued that home working and long-term office closures could in fact revive the high street, as more workers are buying from their local areas as opposed to shops around their offices.